What Should You Expect When The Adjuster Comes To Your House To Check For Damages?

A visit to your house by an insurance adjuster can be filled with anxiety, confusion, and some times intimidation, but it doesn't have to be. Adjusters are there simply to do a job and that's to see what damage your property has and calculate an estimate for the insurance company to restore your property back to pre-loss condition.

This article will give you details about what to expect from the adjuster and we'll try to make sense of how the process works.

In this article, I'm making an assumption. That assumption is that you've already filed a claim, or you're about to file a claim, and you're wondering what to expect when the adjuster visits your property. If you haven't already filed your claim, though, and need help, we have an article that explains how to file an insurance claim for property damage from weather events. I recommend that you start with that article.

The Claim Is Filed - What Happens Next?

Once your claim is filed with your insurance company, it's assigned a claim number and is sent to either a staff adjuster (an adjuster who works directly for the insurance company) or a 3rd party adjuster company (adjusters who don't work directly for the insurance company, but who work for an independent company that adjusts losses for many insurance companies).

In most cases, the adjuster will call you and let you know when he'll be at your property. If you want to be present when he's there, be sure to let him know that and he'll schedule his visit to accommodate you.

The reason I said that this is how it will happen "in most cases," is because in times of unusual circumstances, as when Coronavirus was active, some insurance companies were not sending out adjusters. This will be uncommon in most instances.

It's not critical that you be home when the adjuster visits, but it will be helpful. If you're home, you can ask questions about the adjusters findings and decisions.

When The Adjuster Arrives

If you're home when he arrives, the adjuster will introduce himself and probably explain the process of what he will be doing. He may ask you some questions about the damage, especially where you believe the damage exists. This is why it's helpful for you to be home at this visit. If you're aware of something on your property that has been damaged, and you want to make sure it makes it into the claim, be sure to make the adjuster aware of it. This would include items like BBQ grills, patio furniture, hot tub or pool covers, and even your mailbox, but can also include things like broken window panes which may not be visible from ground level.

The adjuster may also ask you if you've had it inspected by a contractor and what recommendations the contractor suggested. He might also ask you if you have already selected a contractor. If the adjuster says that his insurance company has a group of "preferred" or "selected" contractors he can recommend to you, or that he would like you to use, remember that as the insured, you're free to hire the contractor of your choice. There are some definite disadvantages of using a contractor from the insurance company's network, which we'll discuss in a different article.

Your adjuster will check the entire exterior of your house and any other buildings on the property, including the roof(s) and will make notes and take photos of all damaged surfaces. All of this information is put into his report for the insurance company and will probably become part of his estimate if the damage is covered by your policy.

Not only will he be checking the buildings, but will check items known as "collateral" property, such as fences, decks, stamped concrete, windows and window screens, gutters, etc. The goal is to create a comprehensive list of things that were damaged from the storm.

Not only will he be checking the buildings, but will check items known as "collateral" property, such as fences, decks, stamped concrete, windows and window screens, gutters, etc. The goal is to create a comprehensive list of things that were damaged from the storm.

The whole inspection process could take between 1 hour to 2 hours, depending on the scope of the damage and the size of the property. Some adjusters then spend another 45-60 minutes in their vehicle writing up their report. If you're home, the adjuster will likely explain his findings and his recommendations. Some adjusters have the authority to approve a claim on the spot and others have to submit everything to the insurance company for review and a claim rep. or desk adjuster will make the approval decision.

Will You Get A Check From The Adjuster?

Maybe...

If he's a staff adjuster, and has the authority, he may give you a check for your Actual Cash Value amount when he's there. If he doesn't have this authority, or if he's a subcontractor adjuster, you'll receive your ACV check in the mail or it will be automatically deposited into your bank account if you have that option enabled on your account.

Again, if you're home, the adjuster will probably try to explain to you the following:

- How your payments will be sent out. These will be the Actual Cash Value and Recoverable Depreciation checks

- What your Replacement Cost Value could be

- How much your deductible is and how that will be taken out of the claim

This is where most people get a little glassy-eyed and confused. Most of us haven't gone through this process more than a couple times, so it can be confusing for us. An adjuster explains this dozens of times each week, and it's all clear to him, but he may not realize that you, as the homeowner, aren't familiar with all the terms he's using. Often, a homeowner just nods in agreement but end up not really understanding everything. Part of this is because it is confusing, and part of it is because many adjusters aren't very good at explaining it.

Getting The Actual Claim

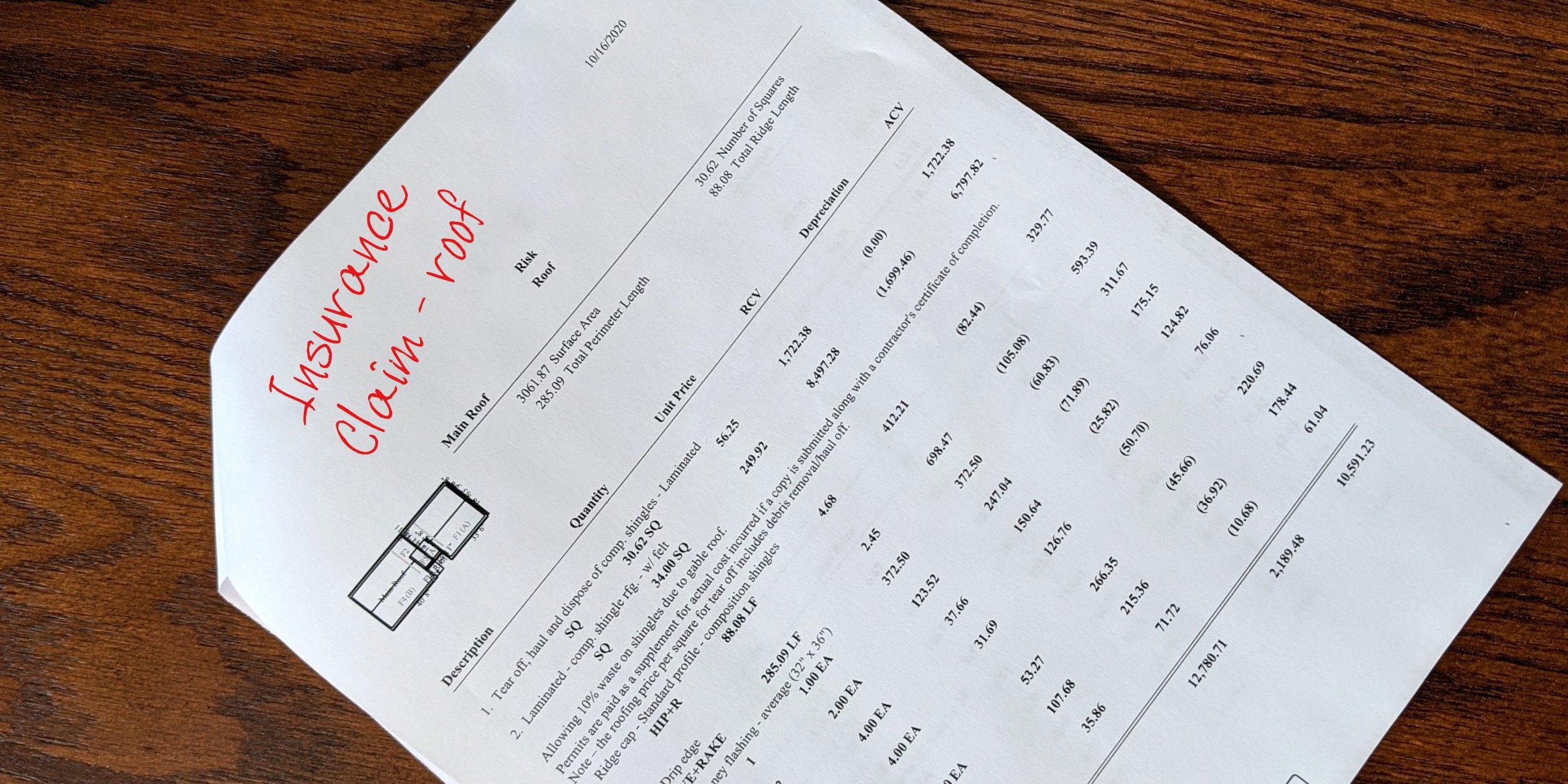

Once your insurance company has accepted the claim, you'll receive a claim document. The adjuster may have prepared that in his vehicle and handed it to you; you may get it in the mail; you may get it in your Email; or it may appear as a document in your online account with the insurance company. This document is also known as the Loss Sheet. It's a very important document.

There's something important to remember about this claim document. It's just an estimate. The reason this is important is because almost every insurance claim estimate is too low. So remember that your claim document is not "set in stone" so to speak. Don't be concerned about the situation if your claim amount is lower than the estimate you've received from a roofing contractor. That's actually a very normal situation.

Homestead Roofing has inspected, repaired, and replaced thousands of roofs in Colorado Springs and the surrounding counties.

As a family-owned business, we take every project personally, committing all our efforts to ensure you and your loved ones have an excellent roof for your living space. Contact us today for more information about our roofing solutions.