The insurance claim process for damage to your home can be confusing.

If you're a brand new homeowner and never had to file a claim before, or, if you've owned your house for a while, but nothing has ever happened to make you consider filing a claim, or, even if you've filed claims for property damage before, if you want to understand how the process works - from start to finish - this series of blog articles and videos will help clarify things and answer most of the questions you may have.

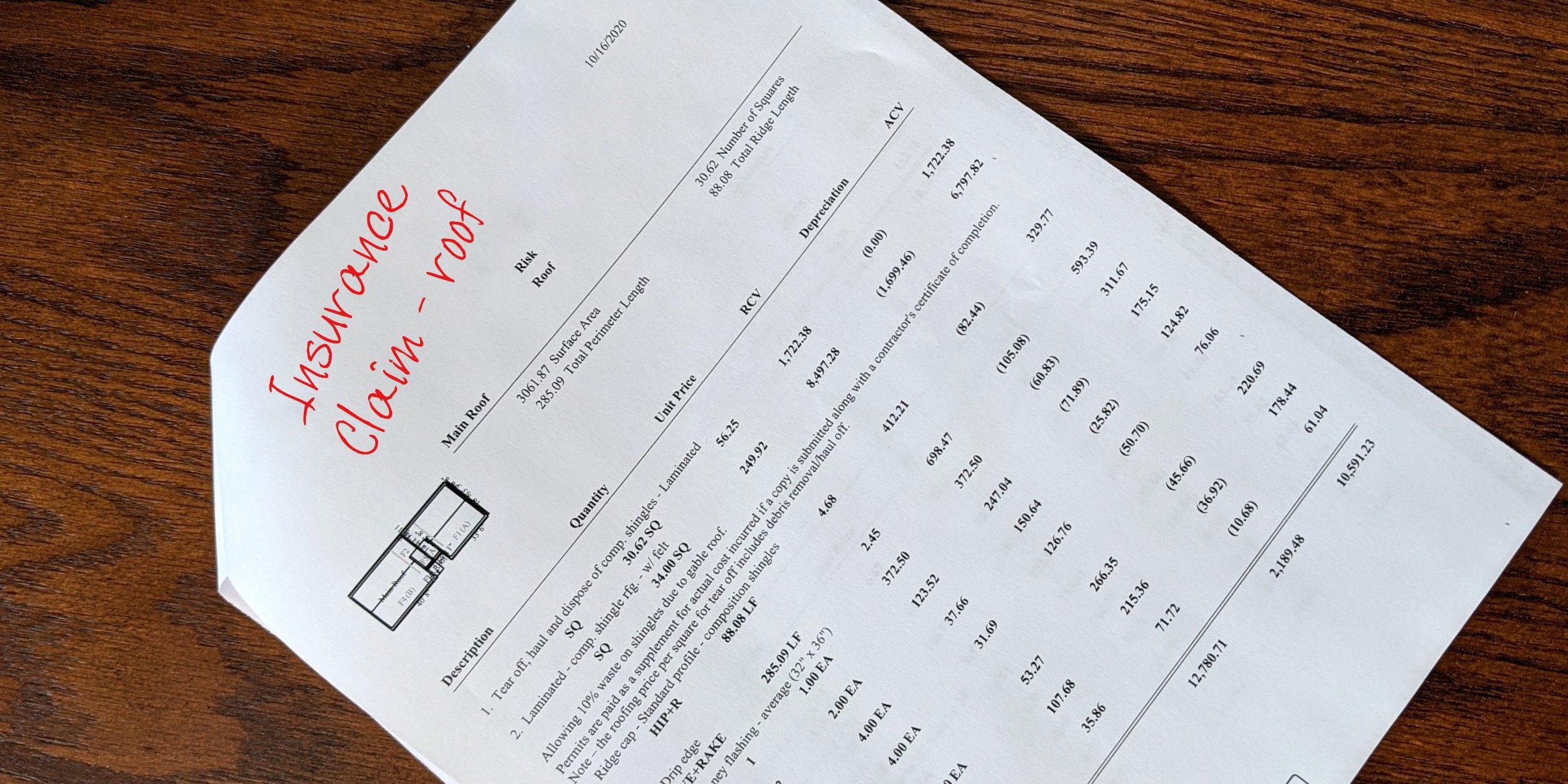

But why is filing a claim so confusing? It's because there are a lot of factors involved and a lot of foreign language used: Recoverable Depreciation, Non-recoverable Depreciation, Actual Cash Value, Replacement Cost Value, Deductibles, loss sheets, damage summaries, etc. Then there are the different players involved: the field adjuster, the desk adjuster, the claim representative, and your contractor(s).

It All Starts With Filing A Claim

The process to file an insurance claim seems simple and easy enough, but this information will give you some guidance on what things your insurance company needs to know and what will happen after you file the claim. Also, at the end of the article, we'll give you some "red flags" to watch for when filing a claim so you don't complicate things for yourself.

What You Need To Know First

Before you can file a claim, there are some things you need to know.

1. You need to know if you even need to file a claim. If you have visible damage, then by all means, you should file a claim. If you can see that your windows, siding, paint, or deck have been damaged, then there's no need to wait to contact your insurance company and get the claim process started. If, however, you don't see any damage, DO NOT call your insurance company. The first thing you need to do, if you suspect you may have damage, or you're just wondering if you have damage, is to call a trusted roofing contractor and ask for an inspection.

Beware!

As soon as a hail storm happens, your neighborhood will be crawling with door-to-door roofing canvassers, all trying to set appointments to inspect your roof. Resist the temptation to let any of these solicitors on your roof. Remember that not every roofer who knocks on your door will rip you off, but pretty much every roofer who will rip you off, will knock on your door.

This is why you need to ask a trusted roofing contractor to inspect your roof. What do I mean by "trusted?" This should be someone you've used before. If you've never used a roofer before, ask your friends, neighbors, family, and/or co-workers for recommendations. If none of them have any suggestions, try going a Google search for "Roofing Colorado Springs" or "Colorado Springs Roofers," then read the reviews on the best ones and also check out their websites. Before you let any of them on your roof, it's a great idea to "interview" them on the phone or in person and find out how their process works and get a "gut-feel" reading on them.

A professional roofer will do an evaluation of your roof and give you an opinion on whether or not he thinks you should file a claim. He should be able to give you some guidance on whether or not your roof has insurable damage, if the roof still has life left in it, or if the roof needs repairs that you may have to pay for out of pocket.

2. You need to know what your deductible is. This is very critical because if your deductible is higher than you think it is, your out of pocket expense - your share of the repair cost - will be more than you're expecting it to be. If your insurance company has increased your deductible, they inform you of that in the declaration page you get when you renew your insurance. The problem is that almost no one reads that document. Don't put yourself in the position of having a very unpleasant shock by finding out your deductible is higher than you thought.

3. You need to know if your coverage includes Recoverable Depreciation or Non-recoverable Depreciation. This is also critically important because it determines how much of the cost of the repairs you will have to pay. If your policy states you have non-recoverable depreciation, you could be facing an out of pocket expense of several thousand dollars.

What Happens Next?

So now you've had your roof inspected and you know there's insurable damage. You've also checked with your insurance company and you understand what your deductible is and your coverage type and you're comfortable with the expenses of both. Now what?

To file your claim, you can either call the claims department - that's normally a toll free number - or you can call your local agent, who normally can help with this process.

If you call the claims department, it's likely that the claims rep will ask you several questions. Among those, there are 2 questions that will stand out and how you answer them could be important.

- What type of damage do you have?

The reason this is important is because some insurance companies may view different types of damage as being caused by different events, and therefore, they could consider those different claims. For example, if there was high winds that accompanied a hail storm and you got hail damage AND lost some shingles from the wind, I would be cautious about telling the claim rep about both. I would stick to telling the claim rep about the hail damage and let the adjuster make the determination about the cause of the loss. The reason I say this is because I've seen 2 homeowners end up with claims for both wind damage and hail damage from the same event because they notified the insurance company of both. A good rule of thumb is: Stick with hail damage. - What is the date of loss?

If you actually know the date that the storm damaged your property, it's OK to tell the claim rep that. But let's say that you recently had your roof inspected and there hasn't been a recent storm. Will you know the date of loss? Probably not. If you don't know the date of loss, don't try to make one up. Don't try to offer a date that you think something happened. The insurance companies keep track of all storms and if you offer a date when there wasn't a storm, that could count against you. If you don't know the date of loss, tell the claim rep, "I don't know."

Next, the claim rep will give you a couple pieces of information that will be important for you to record. First will be your claim number. Then the claim rep will likely give you the name of the adjuster assigned to the claim. The adjuster will probably be contacting you to schedule a time for him to visit your property.

Red Flags!

Everything we've written above should be all the information you need to file your claim, but now here are some things to watch out for.

- Roofers are NOT insurance claim specialists. You'll see lots of roofers advertise this on their trucks, their business cards, and their websites. But what does it mean? Roofers are not legally allowed to read and interpret your policy for you. Roofers cannot use your policy to decide or determine what your insurance company should cover in your claim. Roofers are not allowed to negotiate pricing with your insurance company. Doing so puts the roofer in a position of representing himself as a Public Adjuster which violates Colorado SB38, a law passed in 2012.

- Don't let the roofer call in the claim for you. Many roofing salesmen are pretty aggressive about getting you to file a claim and may offer to do it for you once they get down from your roof. Remember - your insurance claims record is yours, not the roofers. You need to protect your claims record as diligently as you protect your credit score. Remember, you have a few questions to ask your insurance agent or company before you file a claim. Don't let the roofer talk you into filing a claim if that may actually end up hurting you.

Homestead Roofing has inspected, repaired, and replaced thousands of roofs in Colorado Springs and the surrounding counties.

As a family-owned business, we take every project personally, committing all our efforts to ensure you and your loved ones have an excellent roof for your living space. Contact us today for more information about our roofing solutions.