If you are having troubles understanding your insurance claim document for damage that has occurred to your property, you're not alone! Insurance claim documents are confusing. There are a bunch of terms and many of them don't make any sense, there are a bunch of sections that don't seem to relate to anything meaningful, and there is an endless array of dollar amounts and they oftentimes don't seem to add up.

We began this series of articles recently to explain insurance claim documents and you can read the previous article here.

If you're mystified or intimidated by your claim document, hopefully we can help clear up the confusion in this article.

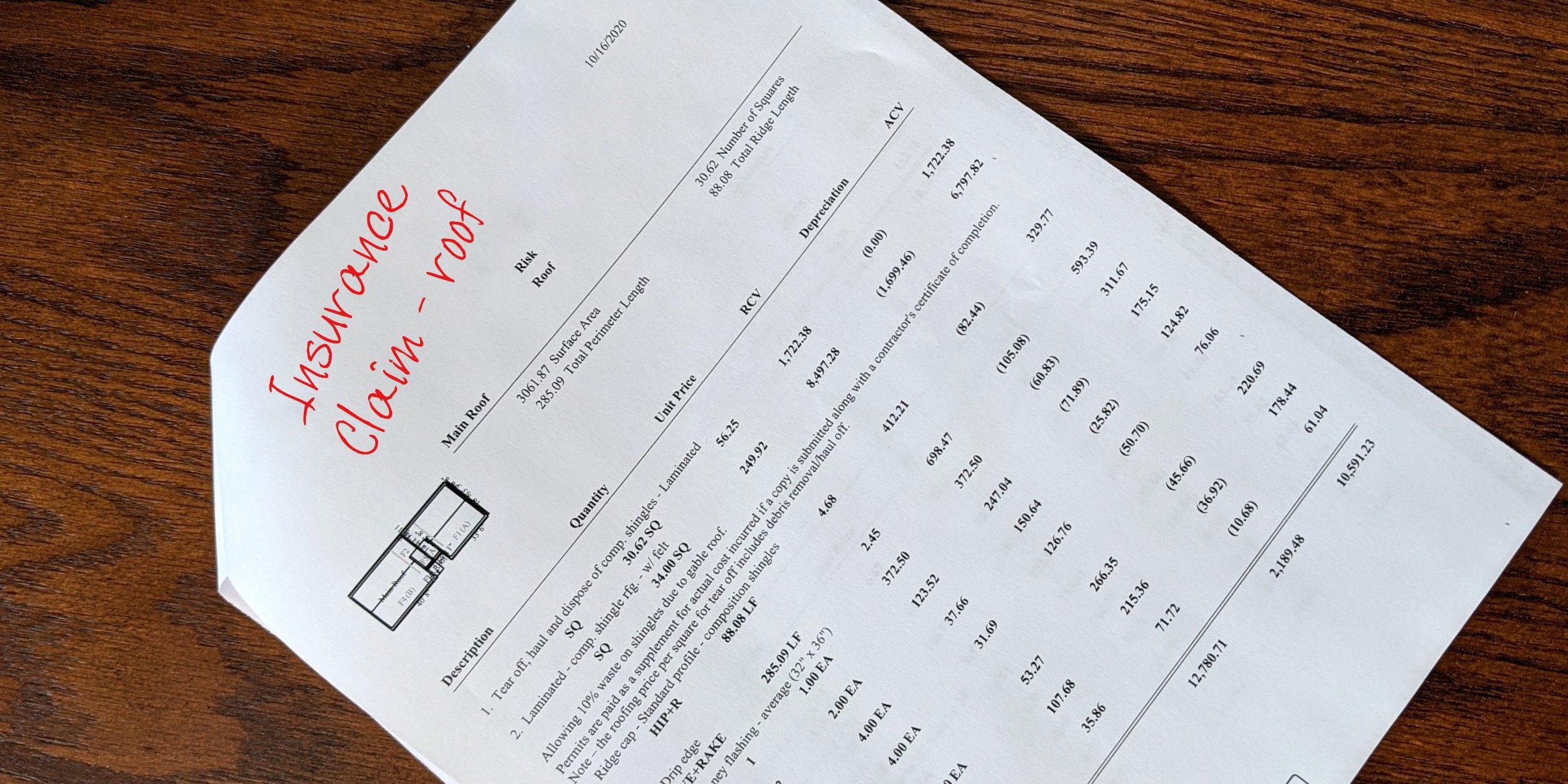

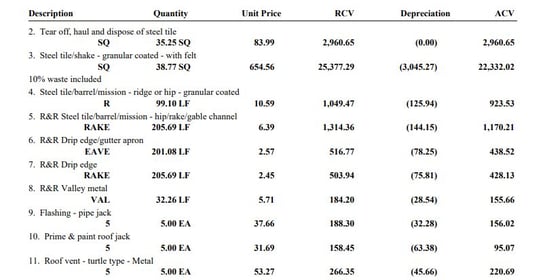

The Actual Estimate Break-down

After the cover pages you'll see the actual itemized lists of the things that your adjuster has included in the claim. These are the items that need to be replaced as part of the restoration of your property.

Since we're roofers, the examples we'll discuss here will be about your roof, however, if damage occurred to other parts of your property, or other buildings on your property, each of those will be broken into their own sections. You may see sections such as the ones listed below:

occurred to other parts of your property, or other buildings on your property, each of those will be broken into their own sections. You may see sections such as the ones listed below:

- Roof (or Dwelling Roof)

- Detached Garage roof

- Front, Right, Rear, Left Elevations

- Gutters

- Etc.

The sections for the "elevations" are for the different sides of your house. They normally use Front, Right, Rear, and Left designations to avoid confusion related to directional designations like North, South, East, and West.

The estimate part of the claim document was originally intended to be just that - an estimate. It was intended by the company which designed the estimating software, Xactimate, to be a "budgetary document" to provide a foundation, or a stepping-stone to start the conversation about the scope of work and potential costs for the property restoration. It was supposed to be a starting point, not an ending point.

Now, however, the insurance companies tend to want to use this document as their "stone tablets" with the 10 Commandments written on them and many times will try to convince homeowners and contractors that they can't make any changes to these documents. This actually isn't the case. If you're working with a professional contractor, he or she will know what information or documentation an insurance company needs to correctly scope your loss.

Do You Need To Understand All This Information?

These pages are probably the most confusing for homeowners. Many of the terms and phrases used will be foreign to the average homeowner. Don't worry about it. If you're working with a contractor, he will understand these line items, and in many cases, your contractor may also be using Xactimate.

The most important point for you to understand about these pages will be that all of these items make up the scope of loss that your adjuster thinks should occur to restore you to "like-kind-and-quality" of "pre-loss" condition.

This is also where your contractor may disagree with the adjuster. Whether your contractor uses Xactimate or not, he will likely have a line item break-down of all the components necessary to complete your repair. There may be items in your contractor's estimate that aren't in your insurance claim, or the items may be in the claim, but may be different, either in measurements or pricing. If so, this is where a supplement becomes necessary.

These pages will also be a big benefit to you in another way. They will help you compare the different estimates you're getting from roofers and will allow you to ask each one about the items that he has in his estimate that aren't in your claim. A professional contractor will be able to give you the information and education about these missing items and explain why they're necessary.

The main point to remember, though, is that just because your claim document doesn't have items that your contractor has, doesn't mean that you have to find a contractor who will only include items that are in your claim, or who will do your project for the price of the claim. As long as your contractor's scope of work and costs are reasonable, within fair market value, and can be justified, your insurance company will adjust their claim.

We have more articles to come explaining your claim document and we'll link to those here.

Homestead Roofing has inspected, repaired, and replaced thousands of roofs in Colorado Springs and the surrounding counties.

As a family-owned business, we take every project personally, committing all our efforts to ensure you and your loved ones have an excellent roof for your living space. Contact us today for more information about our roofing solutions.