Once you have the claim document from your insurance company, what do you need to do next?

Ok, so you've already filed your insurance claim, and the adjuster has been out to your property. The claim has been accepted and now you have a thick packet of paperwork you've gotten from the insurance company. They may have mailed it to you or it may have appeared as a PDF document in your online account with the insurer.

However you have received it, now that you have it, what happens now?

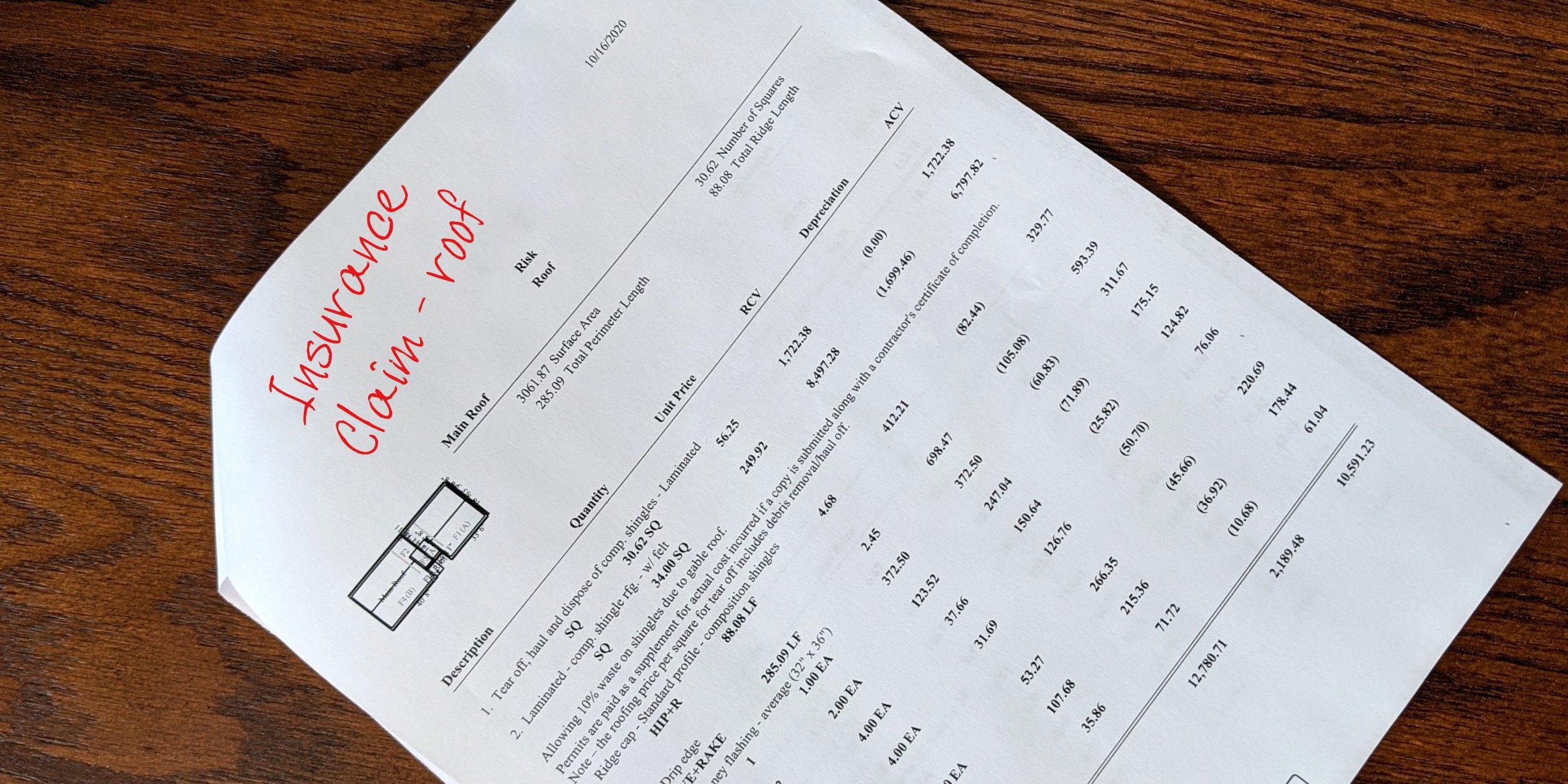

The claim document, also known as the "loss sheet," contains a bunch of information. Some times it has information about your coverage. Oftentimes, it has instructions on how to proceed with getting the repairs done. But always, it will have an estimate of the cost of repairs of the damage on your property.

I can't stress this fact often enough. The cost pages of the claim document are just an estimate. This is nothing more than the insurance company's best guess, based on the information they received from the adjuster, about what it will cost to restore your property.

Although the insurance company wants you to believe, and wants your contractor to believe that this is the amount they will pay, that's actually not the case at all. It's kind of like when you go to a garage sale. You find something you want and maybe it's got a price of $25 on it. Rarely does anyone ever just hand over the $25. Normally they throw out a much lower offer.

Your Claim Amount Is Your Insurance Company's Attempt To Throw Out A Lower Offer

Insurance companies are in business to make a profit. I don't see anything wrong with that. But the insurance companies also know that out of all the homeowners who have property damage and who get a check from an insurance company, around 11% of them will never have the repairs completed. That means that the insurance companies are writing checks that will never get used to do what they have written the checks for - repair the damage. Therefore, insurance companies save themselves a lot of money by making the claim amounts low.

Next, there is a large percentage of homeowners who will agree to the amount that's in the claim, and then try to find a contractor who will do the work for that amount. Once again, when an insurance company makes a low offer in the claim, this works out to their advantage. They just saved themselves millions of dollars again.

All of this incentivizes the insurance companies to offer amounts that are too low to adequately and correctly complete the repairs. If you're working with a professional contractor, you'll discover this right away when you see that your claim amount is lower than the roofer's estimate to do the repairs.

Should you be worried about this?

Since it's normal for the insurance claim to be too low, "out of the box," the next thing for you to do is to sit down with your roofing contractor, or do a Zoom call, to discuss the differences. If you've chosen a professional contractor who understands how insurance companies operate, he'll be able to explain all the reasons why the claim is short on funds. He'll show you all the line items in his estimate and explain what they're for and why they're necessary.

For this meeting to work, and to help your contractor help you understand all the details, it will be necessary for you to show your claim document to the roofer. Many people are hesitant to do this, but your roofer needs to have access to this document.

I'm going to mention an exception to this, though.

If you haven't hired the roofer to do your project, he doesn't need to see the claim document yet. If, however, you have hired the roofer do work on your project, not only will he need to see the claim, but most likely he'll need a copy of it, too, especially if you want the roofer to interact with, and discuss the work with your insurance company. But, always remember, there is no situation where a roofer who you haven't hired needs to see your claim document.

Once you and your contractor have discussed the claim, his estimate, and the project, and you feel like you understand the whole process, you'll want to Email a copy of the claim document to the roofer or give him a physical copy. If you only have a hard copy of the document, and can't make a copy of it for the roofer, make sure that the roofer agrees to return your original copy to you. You don't want to be without that for your records.

You Will Get Future Revisions Of The Claim Document

As your roofer (or you) begins discussing the claim and the scope of work that's necessary for the repairs with your insurance company, and they make changes to the claim amount, you'll begin receiving updated revisions of the claim document. Your roofer will need copies of all of these, too as they reflect changes made in response to his discussions with the insurer.

These revised claim documents may come before or after you have your project completed. If you or your roofer have sent in the the roofer's estimated costs of the scope of work before the start of the job, you'll get those revised documents at that time. If this has been done after the roof is done, you'll get them then. The chances are good that these changes, or supplements as they're called, can happen both before and after the job.

Once the roofer is confident that his project will be appropriately funded from the insurance company, he'll order your materials and get your roof on the schedule, and you're on you're way to getting your brand, new roof!

Homestead Roofing has inspected, repaired, and replaced thousands of roofs in Colorado Springs and the surrounding counties.

As a family-owned business, we take every project personally, committing all our efforts to ensure you and your loved ones have an excellent roof for your living space. Contact us today for more information about our roofing solutions.