What happens if your insurance claim amount is less than your roofer's estimate to do the work you need done?

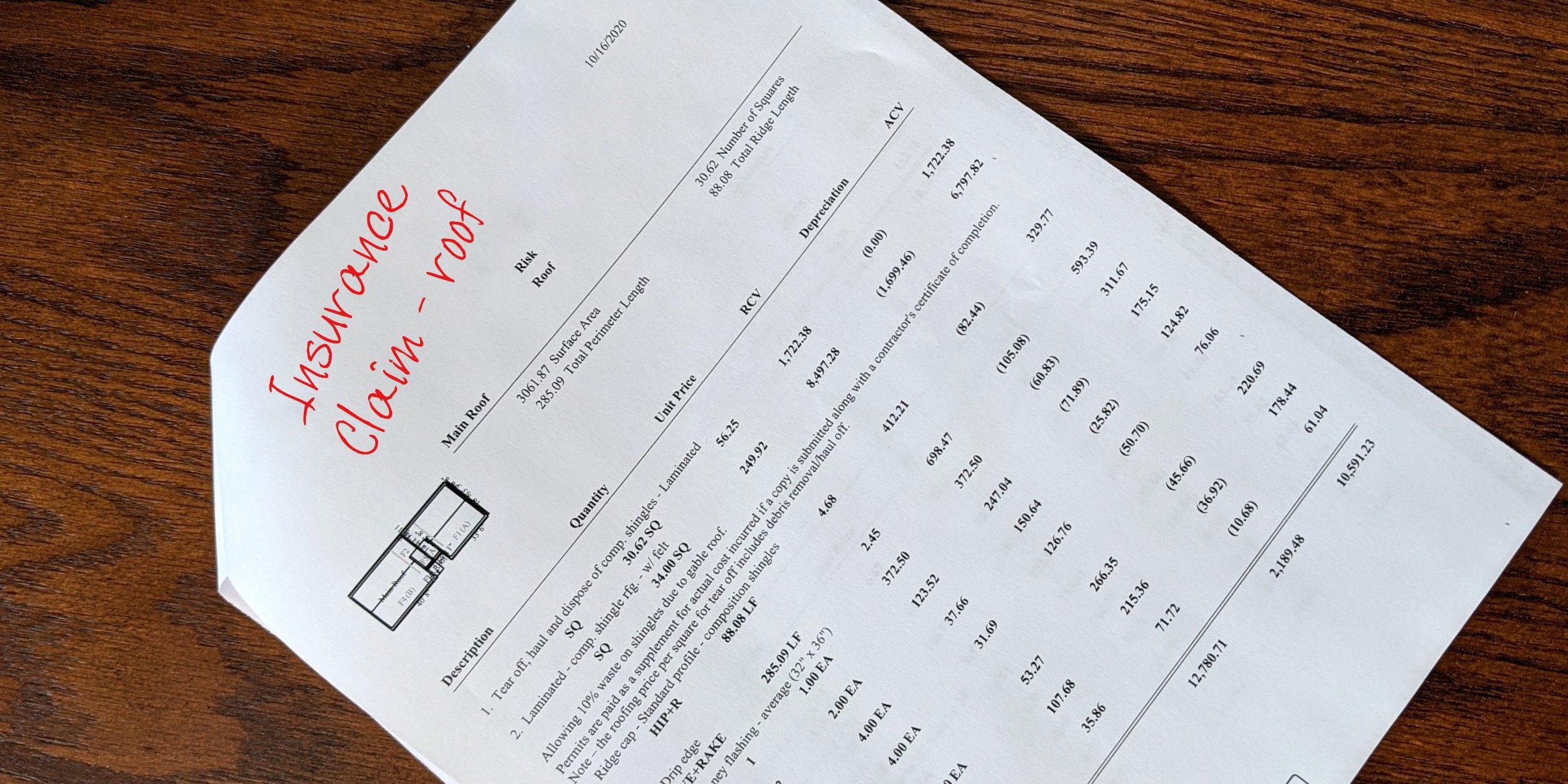

In this article, we're assuming that you've already filed your insurance claim, and the adjuster has been out to your property. Then, you've either received a thick packet of paperwork in the mail, or you've received an electronic version of this paperwork in your Email or in your online account with the insurance company. This is your claim document, also known as your loss sheet.

But guess what? There may be a bump in the road...

In the last article we talked about the fact that your insurance claim amount may be lower than your contractor's estimate. This is actually a very normal part of the process. Insurance companies are incentivized to offer homeowners too little in the claim to actually pay for the work that's needed. The previous article explained why this is.

When this happens, what should you expect from your roofer and your insurance company?

In most cases, your claim document will have one or two paragraphs in the cover pages that explain to you that there may be additional costs that arise during the course of the project. If your roofer's estimate is higher than your claim amount, either you or your contractor can send in documentation explaining why the costs are higher. This is known as a supplement request.

Supplements to the claim amount can be sent to the insurance company either before or after the job is completed.

Why are supplements necessary?

Supplements are necessary in order to make sure that you, as the insured and the homeowner, have 100% of the funds needed to restore your property to like-kind-and-quality, pre-loss conditions.

For example, if you live in an area that has a code that requires you to have a product called ice and water shield on your roof, and your insurance claim doesn't include that in the repair estimate, then that would need to be added to the claim so you receive full payment for the material and labor for the installation of the ice and water shield. If your insurance company doesn't pay for it, and it must be installed to meet code, then you would have to pay for it out of pocket. Since you have insurance to indemnify you against large losses like this, I would assume you would want your insurance company to pay for something like this so this money doesn't have to come out of your personal finances.

So since most insurance claim estimates are too low "out of the box," then supplements are necessary to prevent you, as the homeowner, from helping to pay for the project unnecessarily.

Supplment before, or supplement after? That is the question!

I stated above that these supplements can be sent to the insurance company either before or after the completion of the project. How do you know when to do it?

It kind of depends on how the project is being funded to the contractor and who is doing the supplements.

If you're going to pay the contractor when the job is done and then try to get reimbursed from the insurance company for your incurred costs, then you may want to send in these supplements before the start of the job.

If, however, you have a contractor who will handle the invoicing of the insurance company for you, a good rule of thumb is that if the difference between your contractor's costs and the claim amount is small, or minor, then your contractor will probably complete the work and then send in his invoice, explaining the supplements in that invoice and request payment. If the difference between his costs and the claim amount are large, or major, the contractor probably won't want to risk the outlay of cash that will be on the line and will want some assurance from the insurance company that they'll honor his invoice to them, so he'll probably send in his estimate with the supplements itemized before starting the project.

Regardless of when the supplements are submitted, if all the items in the roofer's scope of work are reasonable, fair, and can be legitimately justified, then your insurance company will include those in the claim. If the insurance company is resisting payment, or honoring your contractor's invoice, then you may need to get involved and call the claims rep or a manager and explain that they need to pay the invoice.

Homestead Roofing has inspected, repaired, and replaced thousands of roofs in Colorado Springs and the surrounding counties.

As a family-owned business, we take every project personally, committing all our efforts to ensure you and your loved ones have an excellent roof for your living space. Contact us today for more information about our roofing solutions.