After one of Colorado's severe hail or wind storms, your roof might take on significant damage and it can be a very stressful time as a homeowner, especially when you start going through the complex and complicated insurance claim process.

Another one of the most common questions we get asked is: Why did my insurance company give me so little money?

There are a variety of reasons your insurance check may be less than you expected but it's often related to a simple misunderstanding of how the insurance claim process works and the type of coverage you have.

Let’s go over some of the most common reasons your insurance check might end up being lower than you expected:

Know the Different Types of Insurance Coverage

There are two different types of insurance coverage for wind and hail damage on your property: Replacement Cost Value and Actual Cash Value.

Related Blog: What's The Difference Between Replacement Cost and Actual Cash Value Coverage

The type of coverage on your policy will have a significant impact on how much you'll pay out of pocket to repair the damage to your roof.

Most people have Replacement Cost Value on their homeowner's insurance policy. This means that your insurance company will pay the full replacement cost to repair the damages to your roof, minus your deductible. They will pay to repair or replace your roof to like-new condition, using the same materials that were on your roof before. The wear and tear and age of your roof isn't taken into consideration. All you'll pay is your deductible.

With Actual Cash Value coverage, your insurance company only pays for what your roof was worth at the time of the loss, and you'll be compensated based on your roof's value in today's dollars. You'll pay the difference between the depreciated value of your roof and the cost of a new roof. So if your home has an older roof, you likely won't receive enough money to cover the full cost of a new roof.

Know How the Insurance Claims Process Works

Knowing how the insurance process works will also help you figure out how to make sure you get what you need after a storm.

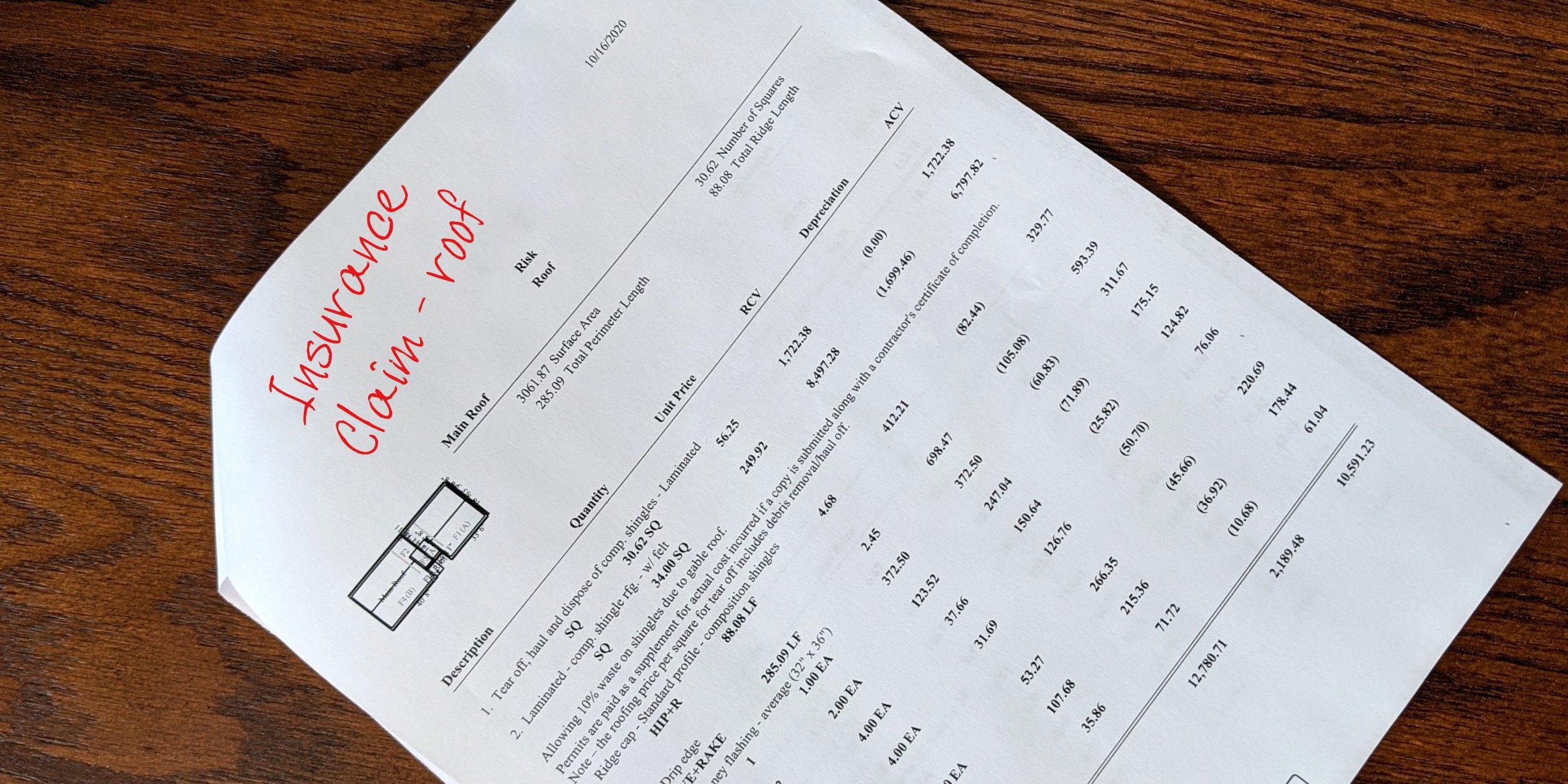

When you file a claim with your insurance company, an adjuster will come out to your home to estimate what it will cost to replace or repair your roof. Let's say their estimate is $10,000. They will then depreciate the value of the materials that are currently on your roof. Your roof depreciates just like a car does. So the adjuster will assign a depreciation amount based on when the last re roof was done.

Let's say the last new roof was put on your home 15 years ago. When the contractor installed it, they likely used 30-year shingles. So your roof is depreciated by 50%. In our example, the adjuster quoted you $10,000, which they'll depreciate by 50%, leaving $5,000.

If you have Replacement Cost Value coverage on your policy, your insurance company will hold back that $5,000 and take out your deductible. In our example, if we assume you have a $1000 deductible, that means your first check would be $4000.

But don't panic when you get the check with such a low amount! If you look at your claim document, you'll see it says "recoverable depreciation" with the amount your adjuster determined. That means you'll get that money back once your roofing contractor sends the invoice to your insurance company at the end of the job.

If you don't see "recoverable depreciation" on your claim, look for a line that says "non-recoverable depreciation." If you see that, it means you have Actual Cash Value coverage, and you won't be getting that money back. If you don't see anything on your claim document about depreciation, either recoverable or non-recoverable, you should call your insurance agent and ask what your policy coverage is.

If you have any other questions about insurance claims, we have many educational materials in our learning center to guide you through the process. You can also contact us with questions anytime.