It's the dreaded question that comes up after a big storm. "What is the actual cash value of my roof?" Unfortunately, many people don't understand what this means and how it can impact their insurance claims. In this blog post, we will explain what actual cash value is and how you can avoid being blindsided by your insurance company when filing a roof insurance claim.

What this Blog will Explain:

1. What is Actual Cash Value?

2. Help you understand if your insurance coverage is “Actual Cash Value.”

3. Every insurance claim has “Actual Cash Value," we’ll explain why.

Actual Cash Value Policy

These policies don’t pay the full amount to replace a roof. They only pay a percentage of the roof’s depreciated value. For example, if you have a $20,000 roof and it’s been on your home for 15 years, your insurance company may only offer you $12,000 to replace it. This is because roofing materials have a limited expected lifetime, so your insurance company will only pay out a portion of the roof’s original cost.

Replacement Cost Value Policy

This is a policy that will give you the full amount to replace your roof. So, if you have a $20,000 roof and it needs to be replaced, your insurance company will give you $20,000 to replace it.

Actual Cash Value Coverage

Think of it like this: if you own a 2015 Hyundai Elantra, get into a wreck and total your car. You make an insurance claim and the adjuster comes out to see the damage, agreeing that it is indeed totaled. The insurance company will then give you enough money for you to buy another 2015 Hyundai Elantra. They won’t give you enough for a newer car; if they did, that would be called replacement cost coverage.

In the auto-insurance world, they look at what the actual cash value is of the make, model, and year of the car you own- They will give you the amount of that exact vehicle minus your deductible to go replace your car.

The actual cash value homeowner’s policy works the same way. For instance, if the last time your roof was installed was in 2009, the adjuster will assess how much it will take to replace your roof, apply 13 years of depreciation to it, and that becomes the actual cash value (minus the deductible) to repair the roof. This is the payment you will receive to cover a new roof, which won't be the full cost of your roof repair. Knowing this is important for any homeowner who has an insurance policy and coverage. If you file a roof claim the out-of-pocket expense will be much higher than if you had a replacement cost coverage.

How Do You Know Which Policy You Have?

Every year you’re going to get a new document for a renewal of your insurance policies which includes your declaration page and coverage information; read through your policies, if they aren’t understood call your insurance agent and ask, “Do I have an actual cash value policy or replacement cost policy?” Also, be sure to ask if that is for wind and hail damage as well; your insurer will typically have different coverage for certain types of losses like these.

Every Claim has Actual Cash Value

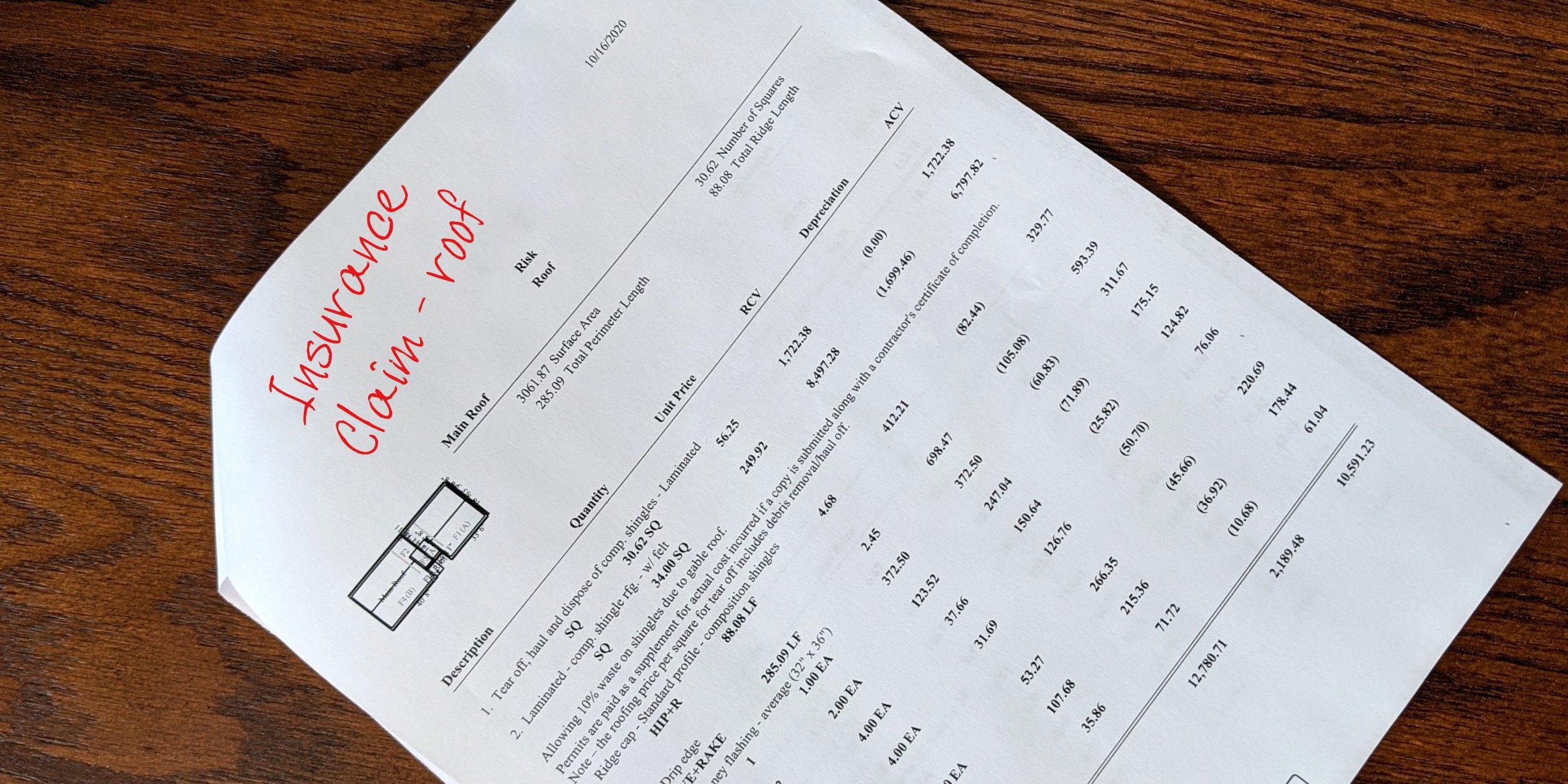

Every insurance claim (replacement or actual cash value coverage) is going to have an actual cash value. On your insurance claim document will be a line showing the total claim amount. The adjuster's assessed value will determine the amount needed to get your roof repaired or replaced. After that line will be the depreciation amount which will either say “less-recoverable depreciation” or “less-non-recoverable depreciation.”

Next, it will have the deductible, followed by the final dollar amount i.e. the bottom line. If you have an actual cash value policy, that final bottom line is the amount of money they will reimburse you for the work done on your roof; an indicator of this is if it says “less-non-recoverable deprecation,” which means you aren’t going to get compensation for the deprecation. If you have a replacement cost coverage, that line will instead read “less-recoverable depreciation,” which means they are holding back the depreciation until the work is done. Once the work is complete, the homeowner will recover the depreciation value. In other words, under this policy, homeowners are given 100% of the money to repair or replace their roof from their insurance company minus the deductible.

If you only have actual cash value coverage on your roof insurance policy your insurer won't reimburse you for the deprecation amount; that is the amount you will need to take out of your pocket to get your roof repaired or replaced.

Conclusion

Here at Homestead Roofing, we believe the best homeowners can receive is a policy with enough benefits that pays today's cost of roof repairs and replacements without subtracting deprecation value. Contact your insurance company today to make sure you have the best policy available. If you have any questions, feel free to contact us today. Roofing is our specialty, and we would be honored to help you in any way possible. Roof on!