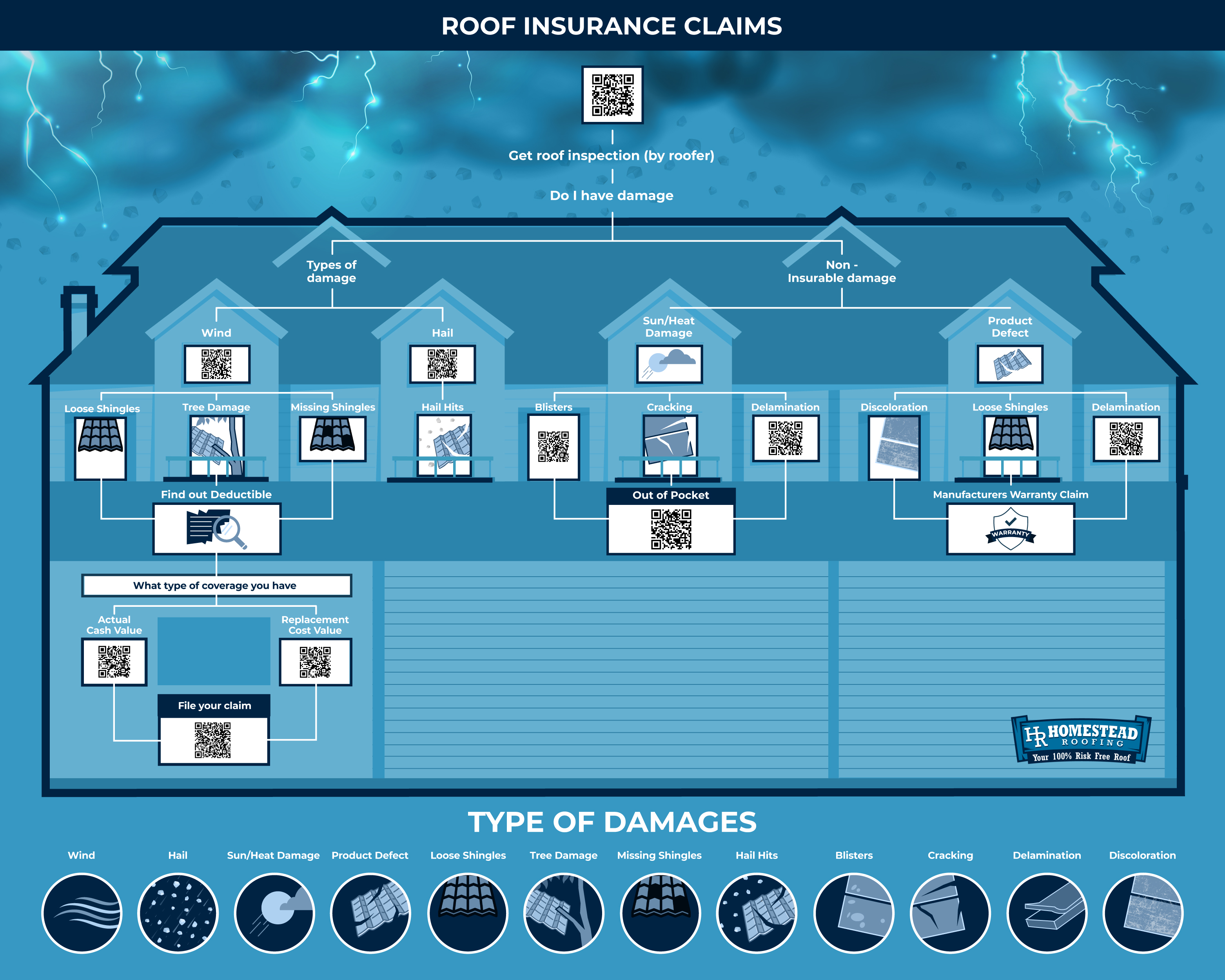

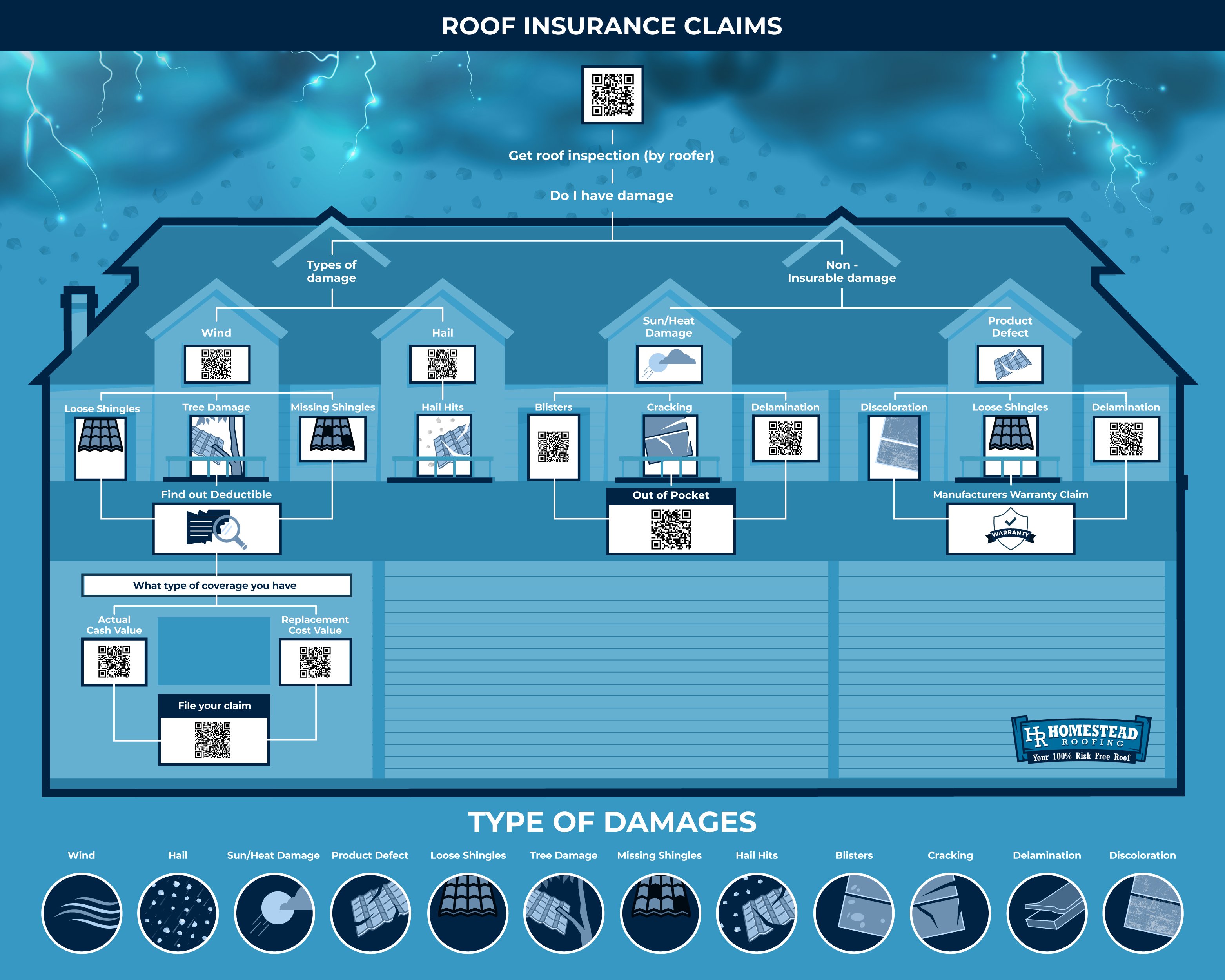

A lot of people will simply turn in a roofing insurance claim because it's an available option, or because a neighbor did exactly that for a damaged roof or roof issues. There's a lot to consider, including claim history (basically your credit score for insurance) and even cost. It's important to weigh all your options before making that decision, so what are all your options? First and foremost, and something we find mandatory before any claims are made, is a roofing inspection by a qualified roofing contractor.

An Inspection is Needed before Filing for a Roofing Insurance Claim

It's important to understand that filing with your homeowner's insurance does not necessarily mean the claims process will go smoothly and your insurance company will approve. An insurance company is more likely to deny a roof claim than pay out, so don't assume that if you file one, you'll get the money from it.

Before filing a roofing insurance claim, make sure to have a thorough inspection performed on your roof by professional roofing contractors. While you may think that this will cost too much and take too much time, keep in mind that doing so could save both of these things down the road—and huge headaches as well!

Then again, before you even go ahead to request an inspection, followed by a possible roof claim, there are other things to keep in mind.

Is There Visible Damage?

After a brutal hail or storm, damage can present itself on your home in the form of broken window hinges, slanted railings, or general signs of wear on your building. If you can spot damages on your house because they're especially glaring, then it's probably a good idea to file with your insurance company.

Now that you've decided whether or not you need one right away, you should consider your homeowner's insurance and insurance policy and what it entails for you.

What is your Policy Coverage Type?

First, let's determine what kind of policy your insurance company covers. If your insurance company offers both basic and all-risk policies, it's a good idea to know the difference between the two. The most important thing to keep in mind is that a basic roof insurance policy covers only certain types of damage, while an all-risk roof insurance policy covers all damages caused by an accident or natural disaster.

Basic policies typically include coverage for fire and lightning damage as well as for theft and vandalism (theft from outside your property). However, they don't cover other types of damage like windstorms or hail—which are covered by all-risk policies. Basic policies also usually feature deductibles: a certain amount that you must pay out-of-pocket before your insurer will step in with reimbursement on anything else related to this type of incident (e.g., if there was $10k worth of damage but only $5k worth covered by warranty).

We've briefly touched on deductibles. Next, we'll go over what that means for your wallet, depending on the type of coverage you have.

What's your Deductible?

You should also take a look at your deductible. This is the amount of money you have to pay before the insurance company pays. Deductibles vary based on the type of coverage you have, but in most cases, they can be waived under certain circumstances. They can also be increased or decreased over time based on how much wear and tear your home has sustained since signing up for coverage. Before you file a roof claim with your insurance company, check to see that the deductible is an amount you have, and are willing to part with. If everything lines up so far, then the only thing stopping you from making a claim, is quite possibly your claim history. If you've had multiple claims in the past, this will directly influence your likely hood of getting this one, and what the costs will entail.

Do You Have Multiple Claims on Record With Your Insurance Company?

If you have a history of making claims, it may be worth it to consider getting the initial repair done yourself. This way, you can avoid future claims and save money on your premiums in the long term. Of course, if your roof is beyond repair or poses a safety hazard, then by all means submit a claim. Once again: don't wait until there's an emergency to research your insurance policy—do it now so that you'll be prepared when something happens!

If you've had multiple claims on your record in the last year or two, then we definitely recommend contacting your agent. While there are some insurers who might still offer reasonable rates to these customers (and others), many insurers will not offer coverage at all if there's been too much activity recently—especially for those who live in areas prone to hurricanes and earthquakes (where damage from storms tends not just be more frequent but also more severe).

Is it Your Permanent Home?

If you're a homeowner, it's likely that your home is your most valuable asset. But what if it's also the location of a roofing disaster?

The answer is simple: If it's your permanent residence and the damage was caused by something covered by your policy (like fire or wind), then yes, absolutely file that claim! You'll be glad you did when those payments start rolling in and help with paying for repairs to the house.

But what if you have an investment property? In this case, filing an insurance claim may not be worth the trouble or expense associated with getting repairs done on time—or even worse: losing out on potential rental income while repairs are being made at no cost to yourself thanks to insurance money coming through!

If this sounds like something that could happen with one of your properties then we'd recommend looking into other options like hiring professionals who specialize in dealing with these situations instead so they can make sure everything goes smoothly during every step along the way (as well as follow up afterward).

Has it Been Inspected by a Contractor You Can Trust?

To find out if the contractor is reputable, you can check with the Better Business Bureau (BBB). The BBB has a database of complaints and other information about businesses that might be helpful to you.

You should also ask for references from people who have used the contractor's services in the past. If you've found a roofing company you trust, look them up on LinkedIn or Facebook and see whether they have any reviews from previous customers. Finally, talk to neighbors who have recently had similar projects done (like replacing shingles) to get their advice about contractors in your area.

Have I Received Multiple Opinions or Estimates?

You’re on the fence about whether or not you should submit a claim for your roof. You’ve already done some research, but it’s still not entirely clear if filing an insurance claim is worth it.

Have I gotten multiple opinions?

This is an important question to ask yourself before making any decisions about whether or not to file a claim. If you haven't sought out an expert opinion and multiple estimates, then you're probably not ready to make your final call yet. You need someone who can take the time and look at the problem objectively before making this kind of decision so that its impact on your home is fully understood and considered.

Ultimately, deciding whether or not to file an insurance claim is a robust decision. Always keep in mind that the right choice depends on many factors, including your coverage type and deductible. Earlier on, we spoke about damage as a key consideration, when filing an insurance claim. It's important to note that not all damage is severe, and not all severe damage is insurable. What do we mean?

Before Turning In an Insurance Claim, How Bad is the Damage?

How much roof damage has been done? If the roof damage is minor (a few tiles have fallen off or some shingles have been blown away), you may not need to file an insurance claim at all. You could get the repair done yourself by ordering roofing materials online, or you could hire a trusted roofing contractor or roofing company who will do it for you at a reasonable cost. In cases like these, filing an insurance claim can actually be more expensive than simply doing the work yourself.

However, if the roof damage sustained is substantial (several tiles are missing or many shingles are blown away), then filing an insurance claim is usually worth doing as long as it doesn't cost more than hiring someone else to fix it. In some scenarios, roof damage has even been left unattended for years, so it makes a lot of sense to consider if the damage is worth fixing, or not.

So you've done the research, and your roof damage does require repairs. Perhaps you're even in need of an entire roof replacement. But before you go on and file that insurance claim, you should know that your insurance does not cover certain types of damage.

Types of Damage your Roof Insurance Won't Cover

While most insurance policies will cover some damage to your roof and possibly roof replacement, there are certain types of damage that aren't covered. For example, if your roof was damaged because the sun's UV rays got through the shingles and onto the decking, or if your roof was damaged by mold from a leaky pipe in the attic, your insurance provider might not accept that roof damage claim, or pay for roof repairs unless that's specified in your insurance policy.

Sun or Heat Damage

Sun and heat damage can affect your roof in two ways. First, the roofing materials themselves can be damaged by repeated exposure to sunlight. Second, the screws or nails that hold the shingles on will expand as they absorb more heat from the sun, causing them to loosen and possibly pop out of their holes. This is called delamination, which occurs when layers in a product separate from each other because of excessive heat.

You may have heard of blistering before on automobiles—it's exactly what it sounds like: a bulging out of a surface due to high temperatures and pressure. Blisters are usually caused by a lack of ventilation underneath shingles as well as insulation around pipes or vents near your attic space (which traps heat). If left untreated over time, blistering could lead to leaks and even structural damage if left unchecked! These kinds of damages can only be covered out of pocket, which means you'll be paying for all inspections, repairs, or replacement costs from your own pocket instead of an insurance check.

Product Defect

Discoloration

This is a product defect that insurance won't cover. Asphalt shingles are dyed so they look uniform and attractive, but some colors fade over time. If your roof has been discolored by the sun's ultraviolet rays, it may be considered a product defect if your policy doesn't cover it. However, any damage that occurred after the shingles were installed can't be claimed under this clause because the company did their job correctly when they installed them, to begin with.

Uncovered/Exposed Nails or Screws

Make sure that all of your nails and screws are covered by asphalt shingles before you install them on your home's roof; otherwise, you could be denied coverage for any holes or tears caused by exposed metal edges left behind when someone walks on top of those areas without wearing shoes or walking on top of something soft like leaves or pine needles instead.

So, what kind of damage is your insurance firm most likely willing to cover?

Types of Damages you can File a Roof Insurance Claim for

Let's take a brief look at wind and hail damage, the two most common causes of extensive roof damage, and how you can file an insurance claim for them.

Wind Damage

One study showed that windstorms threaten an average of 32 million Americans all year round. Wind damage to roofing is usually caused by hurricanes or fairly strong storms. The wind can loosen shingles, even making them disappear all together. If your roof ends up with one or more seams exposed to harsh elements, these seems may let in water. Other critical parts of the roof are the valleys or points where two low parts of the structure meet. Losing a shingle at a low point can cause water and debris to collect, increasing the chances of a leak.

Strong winds can also cause a tree or large branches of a tree to simply fall on your roof, usually causing irreparable damage. But it's not just wind damage that's covered by insurance claims.

Hail Damage

Hail damage to your home’s roof is one of the most severe kinds that can occur. Because hail is so heavy and fast-moving (at speeds upwards of 100 mph), it can cause extensive damage even to roofs made out of strong materials like metal roofing or slate.

Hail damage is usually covered by insurance for your roof, meaning you should be covered if any part of your roof sustains hail damage during a storm—even if only part of the roof sustained damage but all parts were present at the time of the storm. If a portion rather than all parts are damaged by hailstones, this still counts as full coverage under some policies: for example, if only half your shingles were damaged in a hailstorm but there was no other evidence that other parts would have been damaged as well had they been present at the time (such as broken windows or doors).

Wind and hail damage is very common and will usually be covered by most reputable insurance companies. Leaving damages from a severe weather event unattended will likely lead to further damage, so it's recommended that you file an insurance claim for these types of roof damage as soon as you can.

Knowing what a typical insurance firm covers is important, but so is knowing what kind of insurance coverage you have.

Seeking a Homeowners Insurance? Know your Options

Actual Cash Value vs Replacement Cost Value.

Roofing insurance claims typically payout based on the actual cash value of your roof, which is the depreciated amount of money a new roof would cost after accounting for wear and tear.

Optionally, some roofing insurance may more accurately cover the entire repair costs associated with mending or replacing your roof, which is generally a preference. Check with your insurance company, and be sure you read the policies of any firm you chose to associate your roofing with

What's the Deductible?

How much money do you pay when filing a claim? That depends on how old your roof is, as well as its condition; it may be subject to a deductible (a fee that you pay before your insurance company does). Some policies also have caps (in their own best interests) on their coverage amounts for repair or replacement costs within a timeframe. If those limits have been reached, then you're out of luck and will have to part with a much larger amount in order to oversee your roof repair or replacement.

How do I File a Claim?

If you're a homeowner with roof damage and wish to avoid further consequences like a higher deductible, contact your insurance agent immediately so they can make an inspection appointment with their insurance adjuster (that's another word for "insurance expert"). Insurance adjusters will look at the damage in person and determine whether or not it qualifies under your policy. They will usually help guide you through the insurance claim process, filing all necessary paperwork if your insurance company decides to accept your claim, and communicating with any contractors who may need to work on repairs.

If you want to get an inspection before you file your roof insurance claim, get in touch!